Very few startups can withstand revenue fluctuations for nearly a decade, and even fewer can hope for a comeback after teetering on the edge amid the pandemic. Aisle, a high-intent dating app, faced a similar hurdle until it was acquired in March 2022 by the technology holding company Info Edge India, which operates platforms such as Naukri, Jeevansathi, 99acres and Shiksha.

But first things first. Launched in 2014 by Able Joseph and Sarath Nair, the app was positioned between Tinder, Bumble or Hinge-like casual dating platforms and online matrimonial services like Shaadi, BharatMatrimony or Jeevansathi.com. The subscription service promised to bridge the two formats — focussing more on all-round compatibility rather than visual cues and ensuring that users looking for serious relationships could find suitable matches.

Additionally, it bucked the conventional wisdom of constant engagement and factored in user churn into its growth outlook, a natural progression when a member meets someone special and exits the platform.

The Bengaluru-based startup launched several vernacular dating sites and apps, considering how a ‘modern and young India’ would want to pursue love and relationships in a digital-first era. Among these were Arike, the country’s first vernacular dating app for Keralites, Anbe for Tamil users, Neetho for the Telugu populace, Neene (for Kannada speakers) and a few other apps/sites.

Before its acquisition, the startup raised $1.15 Mn across four rounds from a clutch of investors such as Titan Capital, LetsVenture, ah! Ventures and White Unicorn Ventures. Essentially, it was trying to do everything right to drive its business (more on its exclusive features later).

Meanwhile, casual dating apps thrived throughout the pandemic or earlier due to their novelty and convenience. They became immensely popular and Wall Street’s darlings, as nothing more was required than swiping a finger across a smartphone. In 2022, India emerged as the fifth fastest-growing market for dating app spending, with a $31 Mn rise in user expenditure compared to the previous year.

According to Grand View Research, the country’s online dating app market is projected to reach $1.01 Bn by 2030 from $547.9 Mn in 2023, at a 9.2% CAGR. Globally, the revenue forecast is $14.4 Bn.

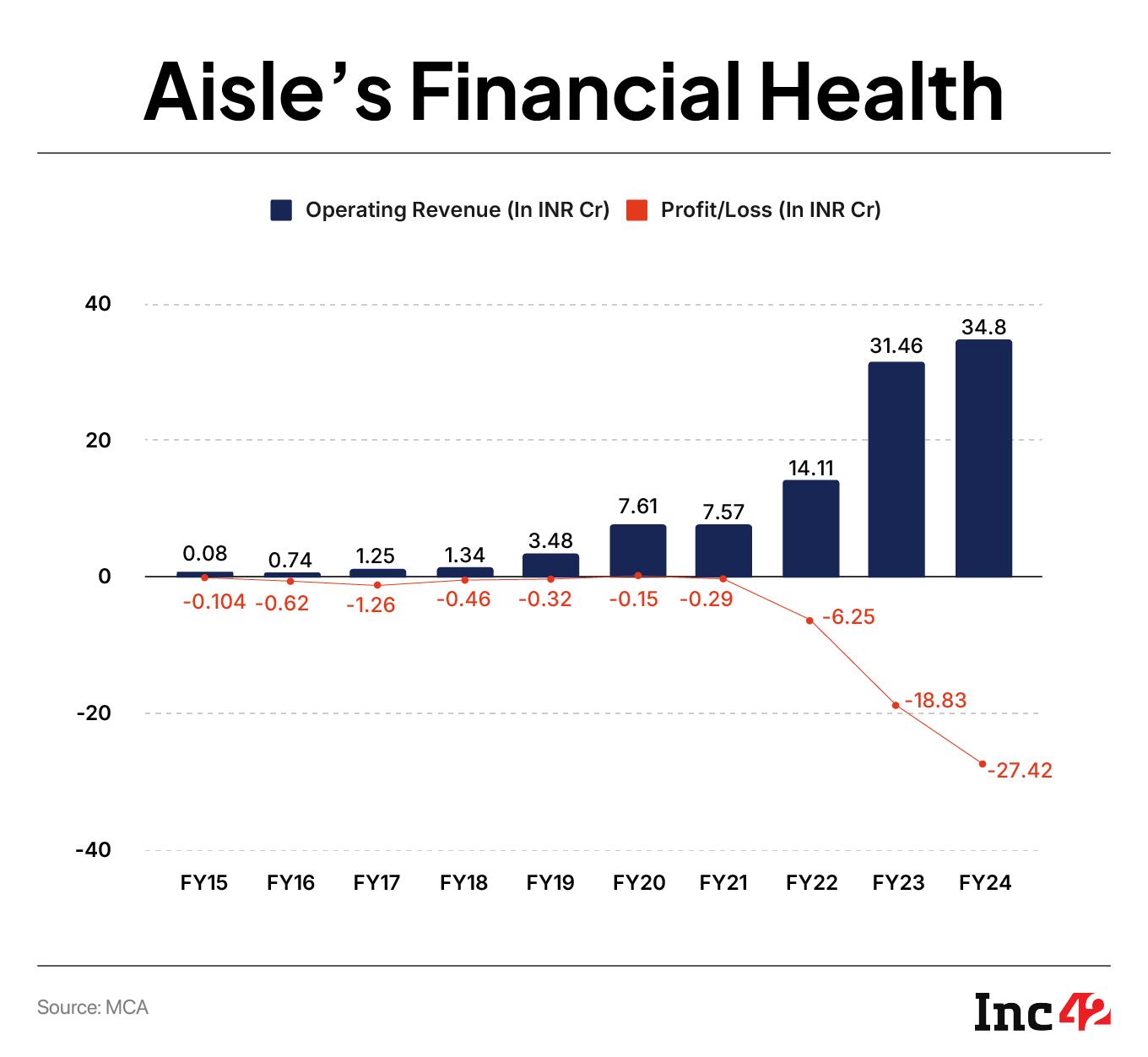

Despite a growing market for digital dating services, Aisle struggled to achieve profitability. In FY22 (ended on March 31, 2022), the startup generated operating revenue of INR 14.11 Cr but reported a loss of INR 6.25 Cr. The previous year (FY21) saw revenue of INR 7.57 Cr, with a narrower loss of INR 29 Lakh. In fact, FY20 was the only exception, when Aisle posted a modest profit of INR 15 Lakh on revenue of INR 7.61 Cr. Before that, it recorded losses for five consecutive years since FY15.

The venture was at a critical crossroads as it faced mounting challenges. Should it press forward and take a real shot at building Aisle as one of the largest dating companies? Or should it scale back and rethink the future? As Info Edge stepped in and acquired a 76% stake in Aisle for INR 91 Cr, the startup could push ahead.

Why Info Edge Joined The Aisle Party

An early backer of prominent startups such as Zomato and PolicyBazaar (the foodtech giant and the parent firm of the insurance aggregator are now publicly traded), Info Edge has always been eager to invest in new and differentiated ventures. After acquiring a majority stake in Aisle, it infused an additional INR 30 Cr in March 2025 through its matrimonial portal, Jeevansathi.com. As a result, its total investment in the step-down subsidiary has reached INR 121 Cr. Its shareholding has risen to 92.83% on a fully converted and diluted basis, up from 89.17%.

This strategic push reflects Info Edge’s ambition to dominate India’s up-and-coming online dating market.

“The latest round will help Aisle expand its product offerings and address its working capital requirements. It will further strengthen our offerings in the matchmaking space by addressing the needs of individuals across age groups and backgrounds seeking meaningful connections,” the company said.

An Info Edge spokesperson, requesting anonymity, told Inc42 that the firm gradually increased its stake in Aisle due to the app’s strong user engagement and retention rates among the 25+ age group — a segment often overlooked by global dating platforms.

While many dating platforms grapple with user retention and monetisation challenges, Info Edge has seen distinct value in Aisle’s approach. “Its clear positioning as a ‘high-intent’ dating app has carved a niche among those seeking serious relationships. This aligns well with our understanding of the Indian market, where the emphasis is often on long-term commitment,” the spokesperson said.

“The app’s regional focus has also been a growth driver — especially Arike, which caters to Malayali people. Its success within the country and among the NRIs underscores the potential for culturally curated relationship platforms. This vernacular strategy is critical to our investment thesis in this space.”

Aisle’s Playbook For A Turnaround Amid Stagnation

With the pandemic gone and barriers against real-life mingling disappearing, will online dating continue to thrive as it did a couple of years ago? A 2023 survey by Pew Research Center revealed that even in the US — the biggest market globally — just 30% of the adults ever used a dating site/app, and only 1% of partnered adults met their current significant other via that route. (For those under 30, it happened to be 50%.)

According to global estimates, dating app installations and sessions also saw a 13% year-over-year drop from January 2023 to December 2024. International giants like Tinder and OkCupid also witnessed a 20-25% decline in monthly active users between October 2022 and September 2023, indicating slowing growth. Closer home, the stagnation also posed persistent challenges without actual disruptions, and many companies failed to revamp their appeal.

An industry insider terms it a generational shift, pointing out that most millennials are married by now and have outgrown these apps. Young people (read Gen Z) are still keen to try it, but those with less disposable incomes are not willing to pay high subscription fees even for premium features. These daters are increasingly looking to free and popular platforms like Instagram or Snapchat for direct messaging. Conversely, the bulk of the revenue earned by dating apps comes from subscriptions and only a small percentage from digital advertising. Add to that the growing customer acquisition cost and life is anything but rosy for these businesses.

When Aisle started operating under Info Edge, it underwent a leadership shakeup, paving the path for spinning things around. As confirmed in his LinkedIn post, Founder Able Joseph officially stepped down a year ago. In February 2025, Chandni Gaglani was appointed the new head to lead the company into its next phase of growth.

An alumnus of the Indian School of Business (ISB), she spent more than a decade at Flipkart, Myntra and Udaan, thriving in various leadership roles.

Aisle has developed and deployed several strategies to deepen its competitive advantage post-acquisition. According to Gaglani, the platform now enjoys greater access to Info Edge’s shared resources. Integrating core functions like HR, finance and technology into the startup’s central teams has helped Aisle streamline operations, focus more on innovations and push for market expansion instead of merely coping with day-to-day operational challenges.

Info Edge has invested heavily in Aisle’s technology and product portfolio to improve its performance and ensure a more engaging user experience. According to the spokesperson mentioned earlier, the platform has significantly ramped up its marketing efforts through social media and content-driven campaigns to boost brand visibility and attract a bigger audience.

Aisle’s most significant innovation in this phase is Aisle Experiences, an invite-only programme officially launched in August 2024. It focusses on building a quality-driven community and creating offline events that cater to shared interests, such as wine-and-cheese nights, jam sessions and other interest-based meetups. The goal is to foster genuine connections in a relaxed, safe environment rather than routine swiping or indiscriminate user acquisition.

“Data shows that most meaningful matches occur within common interest groups. Aisle Experiences aims to bring people together based on that insight,” said Gaglani. “When fully rolled out, this initiative will refine the Aisle community through clear brand messaging, data-driven profiling and exclusive invite-only events. These will support its positioning as a premium, intention-driven dating platform.”

Aisle also provides greater transparency by displaying the number of interactions a match had in the past three days. Premium members can benefit from advanced profile filters and photo verification. Recognising the importance of attracting women users, it has also introduced features designed to enhance their experience. Private Mode, for instance, allows women to browse profiles discreetly until they choose to engage. Again, only women can initiate chats after a mutual match to curb unsolicited messages.

To further strengthen its branding, Aisle is experimenting with customised, cohort-based pricing — tailored subscription plans to cater to different users. A recent pilot saw subscription costs reduced by more than 50%, with varying responses across markets. “NRIs responded positively to the price drop, while urban Indians on iOS were more receptive than their Android counterparts. We are moving towards personalised subscription plans based on app usage to make profile-matching more accessible and effective across demographics,” said Gaglani.

Currently, Aisle charges INR 1,500 as a monthly subscription fee.

Historically, Aisle has maintained a lean tech infrastructure, but it is now transitioning to a microservices model that leverages Info Edge’s technological resources. While AI integration is still early, Aisle Network is exploring AI-driven innovations to improve safety, mitigate cybercrime risks and automate profile matching for better quality and match volume.

“Ahead of broader AI integration, we are focussing on AI-led verification, including live checks to detect image-based spoofing,” said Gaglani. “We also plan to introduce AI-powered tools to encourage more meaningful interactions, moving beyond generic conversations.

A Look At Aisle’s Numbers Post Info Edge Acquisition

Like many of its peers, Aisle struggled to generate substantial revenue in its early years. It failed to surpass INR 1 Cr in the first three years and hit the profit button just once in FY20. But it slipped back in the red and did not see a recovery, although its revenue crept up in FY22.

The turning point came after the Info Edge acquisition. In FY23, its operating revenue jumped by 123% YoY to reach INR 31.46 Cr. Although losses widened during this period due to increased investments and expansion, its revenue rose 10.6% to INR 34.80 Cr in FY24. Overall, Aisle’s operating revenue soared by nearly 146% in two years. The numbers for FY25 are not out yet, but the company managed to reduce its cash burn by 42% and inched closer to profitability, according to Gaglani.

User growth across its key apps also remains strong. Over the past two years, Aisle has maintained a steady stream of 1 Mn monthly active users. Within Aisle’s portfolio, the flagship app contributes 50% of revenue and user base, with regional apps like Arike, Anbe and Neetho accounting for the rest, noted Gaglani. The company claims an overall user base of 16 Mn and counting.

In another sign of surefire growth, Aisle has expanded its team from 20 to 49, setting up new divisions and looking at more investments for product and leadership development to fuel continued expansion.

However, Gaglani stresses upholding the core mission. “Globally, dating apps lean towards the hookup culture, but Aisle has always set itself apart. It avoids swipe-based features and encourages deeper engagement,” she said. “More importantly, its apps were primarily created for individuals aged 27-35. Right now, we are seeing an influx of Gen Z users. Nevertheless, our core mission remains unchanged, although we filter our target audience more effectively.”

Aisle’s Roadmap For Scaling Up

Aisle aims to redefine the dating landscape in India, both qualitatively and through tech power. Understandably, AI will be the next big bet for profile matching, along with hyperlocal engagement and experiential dating. Although things are still at an early stage, the company is now refining these strategies to disrupt the industry and chart a course for sustainable expansion.

At the core of its growth strategy lie user engagement, retention drive and moving beyond digital matches to foster community-driven connections.

On the monetisation front, Aisle is optimising its investments instead of dramatically increasing them. The company is implementing a city-specific, hyperlocal strategy to deepen its presence in key markets. This tailored approach ensures that each platform within the Aisle Network delivers a unique value proposition, minimising overlap and maximising user value. In the current financial year, Aisle projects a 70-80% YoY revenue growth, driven by deeper segmentation, regional customisation and differentiated offerings across multiple dating platforms.

For Gaglani and her team, going granular and regional matters most as key vernacular apps under the Aisle umbrella have shown strong performance, with Arike recording 45% YoY growth in FY25. As she noted, India’s dating market is highly diverse, featuring distinct regional behaviours that defy global patterns. Although urban areas may resemble metro trends or even the West, where typical user acquisition metrics look promising on spreadsheets, smaller cities in tier II and III regions offer different values, habits and relationship perspectives. Hence, companies like Aisle must adopt a tailored approach, not a one-size-fits-all model.

Given the recent capital infusion, it is evident that Info Edge remains committed to these growth strategies for the long term. The internet behemoth considers these platforms complementary to its matrimony service, Jeevansathi. Therefore, it aims to cultivate a suite of offerings that meet diverse user requirements across dating, relationships and matchmaking.

“Over time, Info Edge will invest in these [vernacular] platforms to build a varied portfolio that serves different audiences and relationship goals,” the spokesperson told Inc42.

Meanwhile, Aisle must prove its mettle, personalise its services, and offer flexibility to all user groups to ensure that the demand for meaningful connections continues to grow in India and around the globe. After all, nearly 50% of Indian men and women never got married, and the number is rising, throwing open a massive market for the likes of Aisle.

[Edited By Sanghamitra Mandal]

More from LIVE and Trending Now

RJ Mahvash Lavishes Praise On Yuzvendra Chahal Amid Dating Rumours, Calls Punjab Kings Player ‘Great, Most Caring Person’

Yuzvendra Chahal and RJ Mahvash have been rumoured to be dating shortly after the cricketer's divorce was finalised with …

Is being good with pets a green flag? Relationship expert shares how this may be the new love language

When you are on a dating app and swiping through profiles, have you come across one that …

Stebin Ben shuts down dating rumours with Nupur Sanon, says their bond is purely platonic: ‘Yes, I am single’ | Hindi Movie News

Singer Stebin Ben has officially addressed long-standing speculation about his relationship with Nupur Sanon, and fans hoping …